Millennials are notoriously known for budgeting and saving behaviour that’s either lacking or non-existent, all the while grappling with high levels of debt. This is due to many contributing factors, some of which are not in our control such as the decline of our national economy. It leads to adverse impacts on our financial lives as the cost of necessities become high and people’s incomes take a significant hit.

But it is also due to not knowing exactly how to budget and save money in a way that’s realistic and practical for you. Many experts will emphasise the importance of budgeting and saving but neglect to provide you with actionable steps to budget and save, according to your earning segment.

To help you with that, we’ve compiled useful information on how to budget and save money for long-term benefits. But first, let’s give budgeting and saving money definitions.

What is budgeting?

Budgeting is a planning process that details how and where you will spend your money. This spending plan follows and balances your expenses according to the amount of money you earn. It helps you track your spending habits. The more you’re aware of how much you spend and where you spend it, the more you’re able to improve on it and make changes that will positively benefit you. For example, if your budget shows that you’re spending more money on take-aways than necessary, you can start cutting back on that and direct that money towards your savings plan.

What is saving money?

Saving money is self-explanatory, it simply refers to money that you put away or aside for a time when you will need it, usually for emergencies or big goals such as buying a car.

Now that you know what these are, let’s get to how you can feasibly achieve doing them consistently to help you reap the rewards in the end.

Develop a simple budgeting plan

Often-times we overwhelm ourselves with complicated budgeting plans that confuse us to a point that we end up stopping budgeting altogether. So, develop a simple plan which will be easy to follow, get you to pay your bills on time, get out of debts and still give you a bit of freedom to spend on things that add value to your life and well-being. All within reason of course.

Set-up your financial goals

Start with setting up your financial goals, give them names such as “payback R15 000 student loan”. This way, you know exactly what you’re working towards and you can break it down in a way that is practical for you. For example, you can start planning to pay back R1000 a month if your overall budget allows you to. You do this consistently and in 15 months you will finish paying back your loan.

Use a budgeting spreadsheet or app

Use technology to your advantage and opt for a digital spreadsheet or an app instead of manually drawing a budget on a notebook. These tools typically provide you a guide according to your goals, income, and expenses. They will also help you automatically track your spending and savings and have access to this data whenever and wherever you are.

Automate debits and savings

To ensure that you successfully and consistently put money towards savings and pay off debts, set-up an automatic debit order. The recommendation is that you set up a debit order on your payday so that you can be consistent with it no matter how tight your budget is. It also stops you from worrying about manually transferring the money or tempt you to channel it elsewhere.

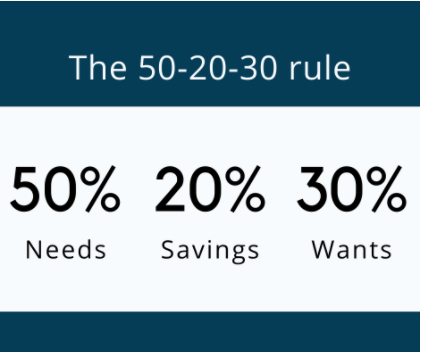

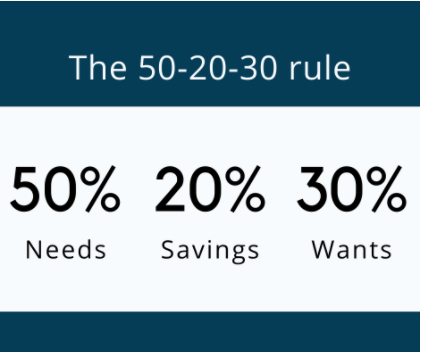

Use the 50-20-30 budget rule

50 percent – You need to allocate 50 percent of your salary to your needs. These are defined as bills that you need to pay for your survival such as rent or bond payment, car payments or public transport, groceries, toiletry, medical aid, debts, and utilities. It doesn’t include extra payments such as your Netflix, DSTV, or Showmax accounts payment. However, if you’re working from home, you can add Wi-Fi payments if your company doesn’t already offer this essential benefit for you.

20 percent – the 20 percent allocation goes to your savings plan, whether it’s a fixed-short-term or long-term plan. It also includes an emergency fund, which you will need in unforeseen circumstances such as job loss or salary cut. It can also include a retirement savings plan if you can focus on this now. The earlier you start on a retirement plan, the more money you can accumulate for your future when the time comes for you to retire.

30 percent – goes to the spending on your wants. This is where you can factor in your entertainment accounts mentioned above as well as dinner with friends or partner even things like wine-pairing. Ultimately, your wants are yours to define. But ensure that you’ve streamlined them in such a way that you can afford to buy them within this percentage bracket. You don’t have to get all of your wants at once, you can spread them out in different months so that you don’t find yourself disappointed when you can’t afford to buy them at once. It’s important to always add your wants on your budget, that way you don’t start to feel like you’re only working to pay bills. Allowing yourself the ability to buy things that add value to your life and make you happy will motivate you to work harder and find ways of improving your budget to get more out of your pay.

The bottom line

Budgeting and saving are difficult to do if you don’t know how to do it in a way that makes sense to you and your income. Learning to put it into practice in a realistic manner will help you spend your money wisely. It will also help you enjoy your life the way you want to and reap rewards in the future.