Inflation has been in the news and even if you haven’t been seeing it, your pockets have certainly been feeling it. As economies across the globe navigate and try to mitigate the effects of inflation, it’s important that you understand the fundamentals. With this knowledge you can make adjustments to your budget, spending and saving to ensure that you continue to take care of your financial well-being.

What is Inflation?

Inflation encompasses the sustained increase in the general price level of goods and services over time. While a moderate amount of inflation is actually good for economic growth, when it becomes excessive, inflation decreases consumer’s spending power. This disrupts financial stability and triggers intervention from central banks. At the moment, several countries have experienced an uptick in inflation due to several factors; increased government spending, supply chain disruptions, and global demand-supply imbalances.

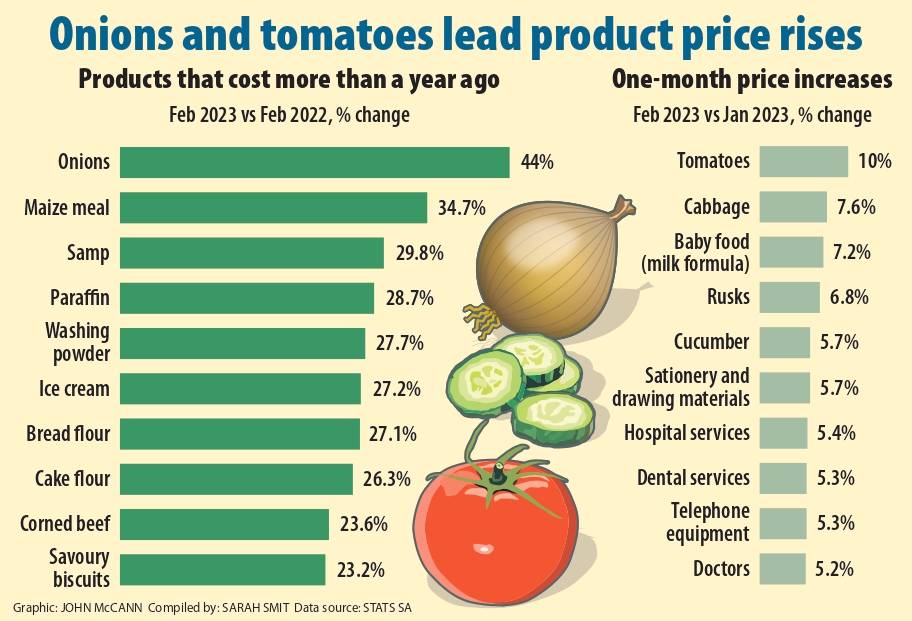

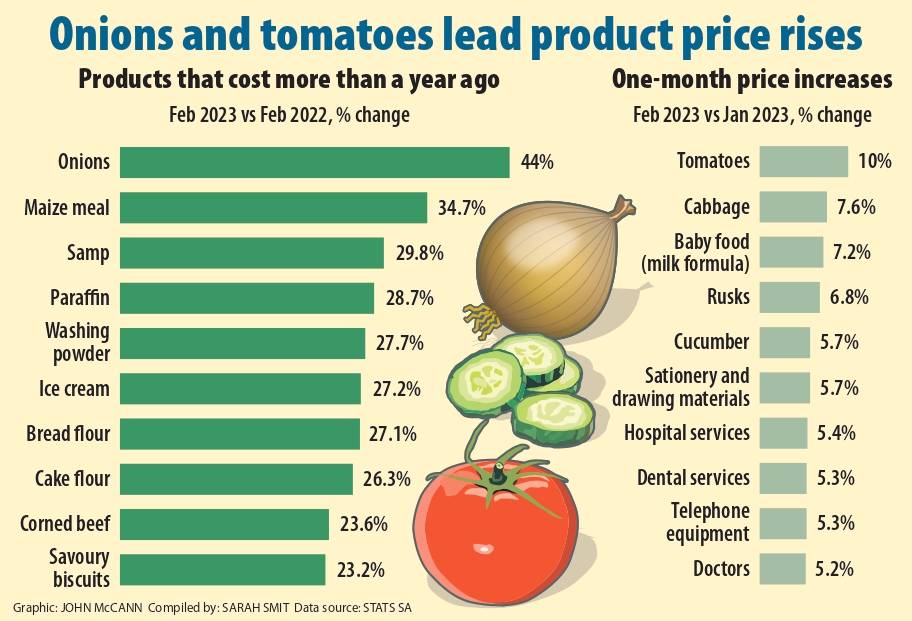

Inflation is more than abstract economic concept. It has a direct impact on the cost of living, affecting the prices of consumables and services.

Source: Mail & Guardian

As the prices of everyday items rise without salaries rising at the same rate, South Africans will feel the pinch. That’s why adjusting spending habits and understanding the impact of inflation is important.

Tips for Navigating Inflation

- Track and analyse expenses: Beyond understanding how much you spend, do a comparison about how much you’ve spent on non-negotiables such as household groceries, medical aid, and education this year vs the same time as last year. Where there is a massive uptick in a category, investigate if you can switch providers or decrease the spending in any way. Also, to compensate for inflation you can adjust your discretionary spending downwards.

- Prioritise needs over wants: In times of rising prices, it becomes essential to differentiate between essential and discretionary expenses. The basics come first, so focus on maximising your budget on housing, food, healthcare and making sure that you have a small nest egg put away for emergencies.

- Save and invest wisely: Another real impact of inflation is that the value of your money decreases. To counter this impact, consider diversifying your savings and investments. Explore different options fixed deposits, government bonds, shares or mutual funds that have the potential to outpace inflation and give you a hedge against inflation.

Want to know more? Check out this helpful explainer video from The Guardian.

PS: Metropolitan GetUp’s funeral cover has the option for a Value Protection Benefit, which helps you maximise your protection and ensures that the value of your protection keeps up with inflation.